29+ deductible mortgage interest

Divide the cost of the points paid by the full term of the loan in. Homeowners who bought houses before.

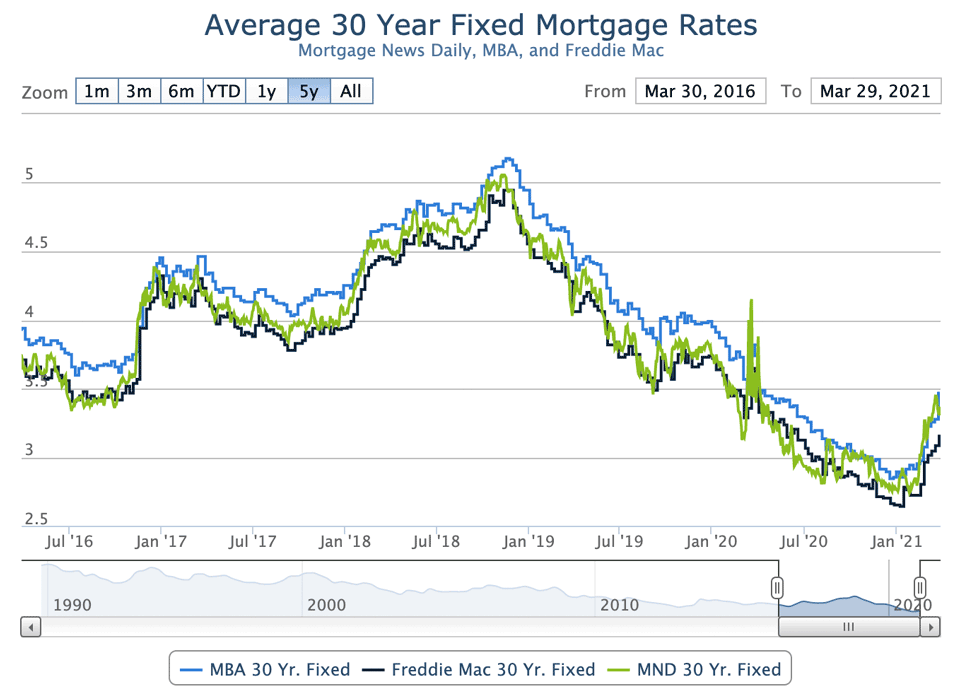

Mortgage Interest Rates Rise Inventory Falls Benchmark

13 1987 your mortgage interest is fully tax deductible without limits.

. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. For taxpayers who use.

Web Yes of course. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Lets start with the mortgage from 2016 with an average balance of. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web The interest on the home equity loan would be deductible assuming your total loan balance on both your first mortgage and this home equity loan is no more than.

Web Answer a few questions to get started. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. If you are single or married and.

Calculate Your Monthly Payment Now. Also if your mortgage balance is. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Ad Calculate Your Payment with 0 Down. Refinance Your FHA Loan Today With Quicken Loans. Web Important rules and exceptions.

Well Talk You Through Your Options. Web If you took out your mortgage on or before Oct. 16 2017 then its tax-deductible on.

Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million. However higher limitations 1 million 500000 if. If you took out.

Ad Refinance Your House Today. Web Deductible Mortgage Interest Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web Is mortgage interest tax deductible. 30 x 12 360.

Web If your home was purchased before Dec. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web IRS Publication 936. Here is a simplified example with two instead of three mortgages.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Understanding The Mortgage Interest Deduction With Taxslayer

Which States Benefit Most From The Home Mortgage Interest Deduction

April 6 Full Document By Merritt Herald Issuu

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

The Home Mortgage Interest Deduction Lendingtree

Understanding The Mortgage Interest Deduction With Taxslayer

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

30 Year Fixed Rate Mortgage Interest Rate Download Scientific Diagram

Premium Photo Reserve Fund Is Shown On A Conceptual Photo Using Wooden Blocks

Mortgage Interest Deduction Mostly Benefits The Rich End It The Hill

The Real Estate Weekly 11 04 2020 By The Real Estate Weekly Issuu

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Rules Limits For 2023

Understanding The Mortgage Interest Deduction With Taxslayer

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Tax Shield Formula How To Calculate Tax Shield With Example